The 9-Second Trick For Frost Pllc

The 9-Second Trick For Frost Pllc

Blog Article

The Ultimate Guide To Frost Pllc

Table of ContentsThe Definitive Guide to Frost PllcMore About Frost Pllc

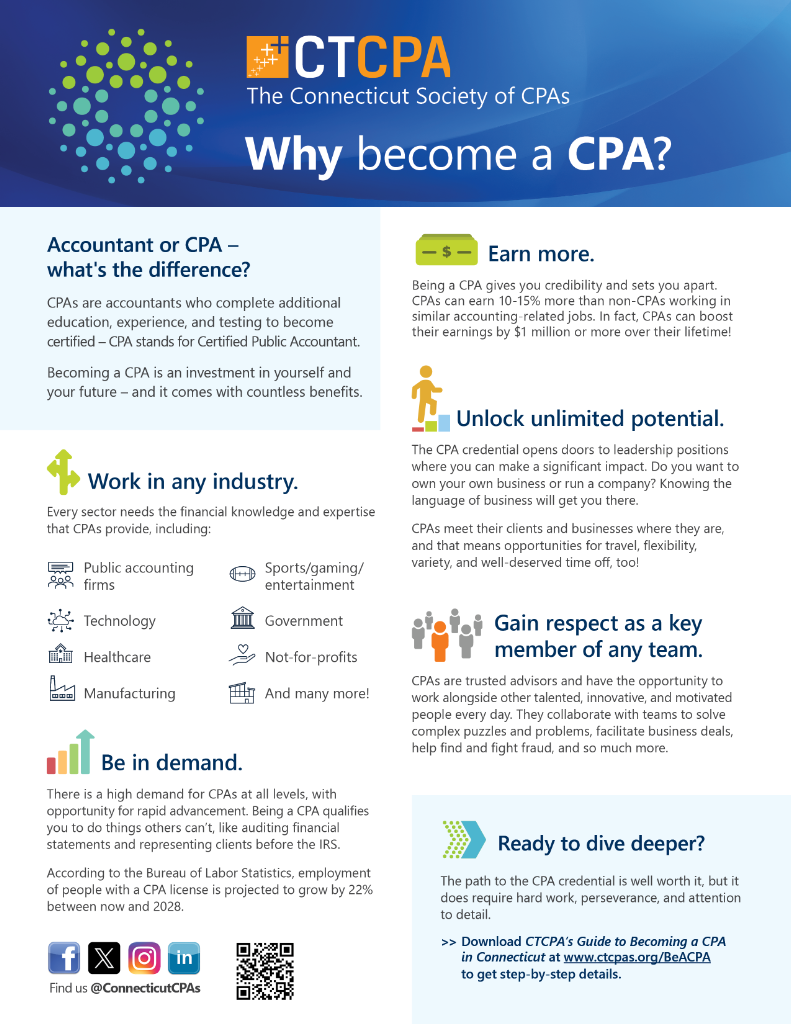

Certified public accountants are the" big guns "of the accounting market and usually do not handle daily bookkeeping jobs. You can make certain all your financial resources are existing and that you're in great standing with the internal revenue service. Working with an accounting firm is an apparent option for complicated services that can pay for a qualified tax obligation specialist and a superb alternative for any kind of local business that wishes to lower the opportunities of being examined and unload the worry and frustrations of tax obligation filing. Open rowThe difference in between a certified public accountant and an accounting professional is just a legal distinction. A CPA is an accountant accredited in their state of procedure. Only a CPA can offer attestation solutions, work as a fiduciary to you and act as a tax attorney if you face an IRS audit. No matter your circumstance, even the busiest accountants can relieve the time worry of filing your taxes on your own. Jennifer Dublino added to this short article. Source meetings were conducted for a previous variation of this short article. Accounting firms may also use CPAs, yet they have other kinds of accountants on team. Usually, these other kinds of accountants have specializeds across areas where having a certified public accountant license isn't called for, such as management audit, nonprofit audit, expense audit, government accounting, or audit. That doesn't make them much less qualified, it simply makes them differently certified. In exchange for these stricter laws, CPAs have the lawful authority to authorize audited financial declarations for the objectives of approaching capitalists and securing funding. While audit companies are not bound by these exact same laws, they should still comply with GAAP(Usually Accepted Bookkeeping Concepts )ideal practices and display highhonest criteria. Consequently, cost-conscious little and mid-sized companies will frequently use a bookkeeping services company to not just satisfy their accounting and accounting requirements currently, yet to range with them as they expand. Do not allow the perceived eminence of a firm complete of Certified public accountants sidetrack you. There is a misunderstanding that a CPA firm will do a much better task due to the fact that they are legitimately permitted to

take on even more tasks than an accounting company. And when this holds true, it doesn't make any feeling to pay the costs that a certified public accountant company will certainly bill. Services can save on costs significantly while still having actually top notch job done by using an accounting solutions firm instead. Therefore, using a bookkeeping solutions firm is see this here often a far much better value than hiring a CPA

Frost Pllc for Beginners

Certified public accountants likewise have experience in developing and perfecting organizational plans and treatments and evaluation of the practical requirements of staffing designs. A well-connected Certified public accountant can leverage their network to aid the organization in numerous strategic and speaking with duties, successfully attaching the organization to the ideal prospect to accomplish their demands. Next time you're Learn More Here looking to fill a board seat, take into consideration getting to out to a CPA that can bring value to your company in all the ways noted above.

Report this page